Hickenlooper: “If the Trump administration gets its way, it’s clear who the winners will be: loan sharks, shady mortgage companies, junk fee merchants. And the losers will be the rest of America”

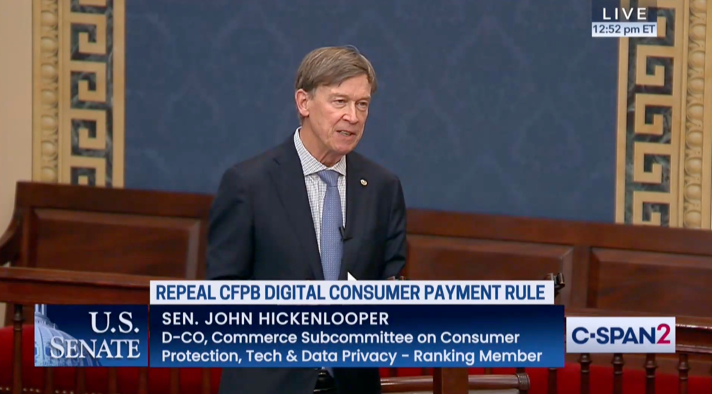

WASHINGTON – Today, U.S. Senator John Hickenlooper spoke on the Senate floor against the Trump administration’s effort to gut the Consumer Financial Protection Bureau (CFPB), the federal agency responsible for protecting American consumers from financial abuse. Hickenlooper spoke before a Senate vote on a Republican-led resolution to strip the CFPB’s power to supervise popular digital payment apps like Venmo and PayPal in order to prevent harms to consumers.

“Today’s Republican-led resolution weakens the CFPB’s ability to protect consumers. And it’s part of a broader effort by the administration to shut down consumer protections entirely,” said Hickenlooper. “Bottom line: More money in the pocket of fraudsters, scammers, and the unscrupulous. Less for the little guy to save.”

At the beginning of February, the Trump administration shut down the CFPB headquarters and ordered all employees to immediately stop all of the agency’s work. On Monday, a federal judge extended an order pausing mass firings at the CFPB.

Since its founding, the CFPB has recovered $20 billion for Americans who have been taken advantage of by scams, junk fees, and high-cost loans. In Colorado, nearly 67,000 people have sought the help from CFPB, including more than 6,200 service members. Thousands of those complaints led to relief for consumers.

To download a full video of Hickenlooper’s remarks, click HERE. A full transcript of his remarks is available below:

“Mr. President,

“The Consumer Financial Protection Bureau is, at its core, a law enforcement agency.

“Congress established the CFPB 15 years ago to protect Americans from fraud, from getting ripped off by banks, and credit card companies, financial institutions.

“Today’s Republican-led resolution weakens the CFPB’s ability to protect consumers. And it’s part of a broader effort by the administration to shut down consumer protections entirely.

“Let’s take a minute to go back in time to the time before the CFPB existed – right before the 2008 financial meltdown.

“Back then, abusive fees and misleading disclosures meant that Coloradans paid more for mortgages. More for credit cards. More for student loans.

“Fly-by-night lenders made massive profits by targeting vulnerable families with excessively high-cost loans – turning credit from a tool for opportunity into a tool for scams.

“Financial scammers could all too easily slip through the cracks in oversight. There just wasn’t enough oversight. In some case, there was no oversight.

“Our neighbors were getting hit with hidden fees and frauds when they took out a mortgage, when they used a credit card, or if they were just paying for school.

“There was no cop on the beat. The result?

“By 2008, years of this shady, abusive practice helped spark a devastating global financial crisis.

“Six million households lost their homes to foreclosure. A quarter of our families lost 75% of their wealth.

“Americans lost faith in our financial system.

“In 2010, Congress created the CFPB to help make sure that this could never happen again.

“Congress gave it a simple job: to protect Americans from getting ripped off.

“The Bureau cleaned up mortgage markets, debt collection, student loans, and much, much more. It worked to protect veterans and other service members.

“Fast forward to today and the CFPB’s results really speak for themselves. The Bureau has delivered 20 billion dollars – that’s billion dollars with a B – back to Americans through its enforcement actions.

“It’s brought relief to 200 million Americans and small businesses facing scams or abusive practices.

“In Colorado, nearly 67,000 people have sought the help from CFPB, including more than 6,200 service members. Thousands of those complaints led to relief for consumers.

“It really is a remarkable track record.

“That is, until it’s been decided by Republicans that they wanted to eliminate many of these protections – if not all of them.

“This vote today would unwind protections designed for the modern financial system – for the everyday payment apps we all use, like Venmo or PayPal. It would allow some of the largest financial firms in a consumer’s life to stay in the shadows, to operate outside of any oversight.

“That’s exactly the approach to consumer protection we had 20 years ago, before the CFPB, before the 2008 financial crisis.

“This is but the latest attempt to leave consumers vulnerable to scams. In fact, the Trump administration is trying, I think many people believe illegally, to abolish the CFPB entirely.

“They fired dedicated staff who protect consumers. They cancelled the lease on the CFPB’s office. And they literally ordered a total shutdown of the agency – an unprecedented effort to defy Congress.

“The administration believes that CFPB doesn’t deserve to exist. And maybe they think that scammers and fraudsters have finally hung it up and have gone to find honest work.

“But I think the American people know better.

“The administration wants to take our economy back to the time before the financial crisis of [2008] – with weaker protections and no one looking out for consumers.

“If the Trump administration gets its way, it’s clear who the winners will be: loan sharks, shady mortgage companies, junk fee merchants.

“And the losers will be the rest of America – any Coloradan that wants a fair deal on a credit card or a mortgage.

“Bottom line: More money in the pocket of fraudsters, scammers, and the unscrupulous. Less for the little guy to save.

“I urge my colleagues to stand up for American consumers and vote no on this resolution.”

###